To find an opportunity you’ve got to follow the money. Following the money will lead you to the Arbitrum ecosystem.

Arbitrum has been the market leader as a Layer 2 scaling solution, there is an abundance of opportunity here, even in the bear market. This blog will be divided into two parts:

- A high-level overview of Arbitrum.

- How to navigate the Arbitrum ecosystem.

A high-level overview of Arbitrum

- What is Arbitrum?

- Why is Arbitrum important? What is arbitrum used for?

- What are the different Arbitrum chains?

- Who are the big brains involved in Arbitrum?

- Is Arbitrum growing?

- How do transactions actually work on Arbitrum?

- The vision and future of Arbitrum

What is Arbitrum?

A layer 2 solution called Arbitrum was created to assist Ethereum in scaling issues. Although decentralised and safe, Ethereum is slow and expensive to use. Arbitrum employs a solution!

Arbitrum enables low-cost and high-throughput on smart contracts trustless approach made possible by the optimistic rollup that Arbitrum uses.

Why is Arbitrum important? What is Arbitrum used for?

Arbitrum lowers the price and latency of decentralised applications (dApps) for users. This results in the faster, more affordable, and more secure use of your favourite dapps. Keep in mind that ETH transactions in November 2021 frequently cost $100 or more.

Ethereum needs to improve a lot if it wants to bring decentralised finance to the masses. When dApps experience widespread adoption, developers must be able to overcome difficulties associated with constructing at scale. The goal of Arbitrum is to address just that.

What are the different Arbitrum chains?

Arbitrum One: The original mainnet of Arbitrum. Where all the main dApps live, Arbitrum evolved one to…

Arbitrum Nitro: Nitro is the follow-up to Arbitrum One, which has made it quicker, more affordable, and more user-friendly.

Arbitrum Nova: This is for dapps with an absurdly high volume of throughputs, such as games and social sites.

Arbitrum Odyssey: A marketing campaign that has been rewarding users by interacting with Arbitrum, a series of challenges to complete on the chain!

Who are the big brains involved in Arbitrum?

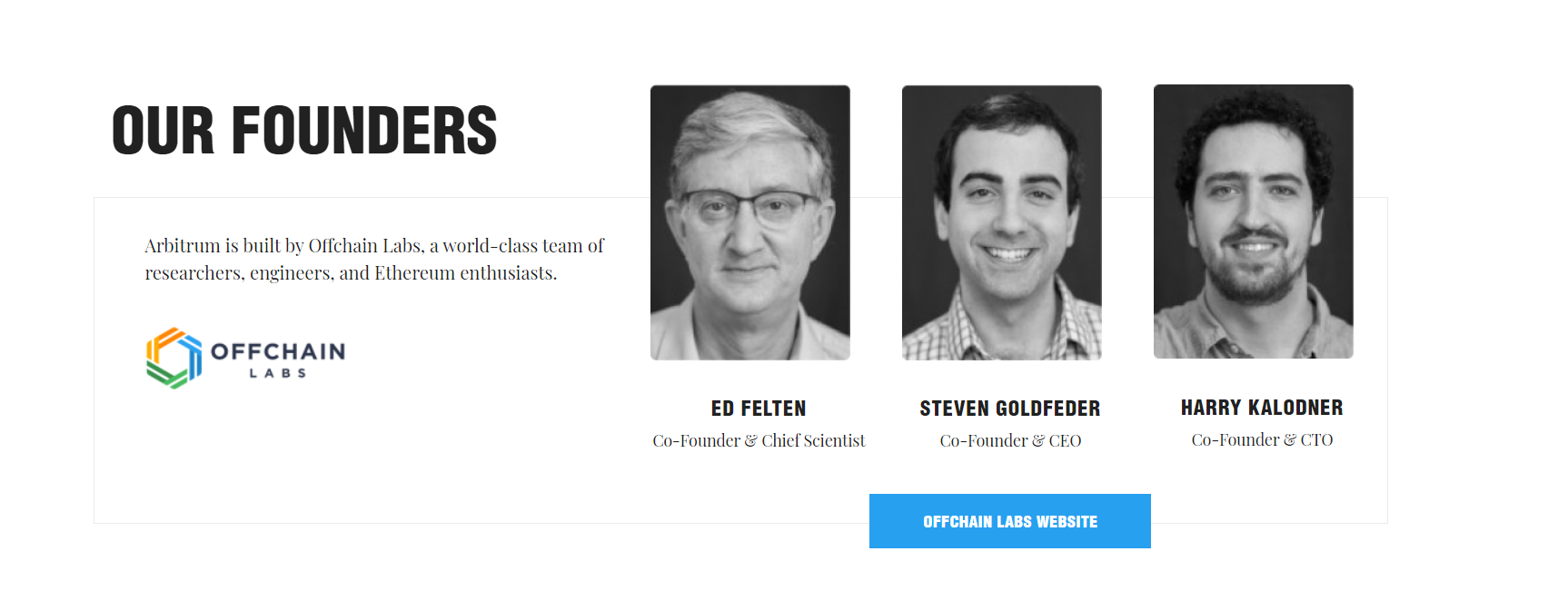

Arbitrum is built by Offchain Labs, a world-class team of engineers, researchers, and Ethereum enthusiasts.

Steven Goldfeder: Co-founder, CEO and Chief Officer at Offchain Labs (the company that created Arbitrum). He holds a PhD where he worked at the intersection of cryptography and cryptocurrencies.

Ed Felten: Co-founder and Chief Scientist at Offchain Labs. A Professor of Computer Science and Public Affairs. Served at the White House as Deputy United States Chief Technology Officer and Senior Advisor of the President.

Harry Kalodner: Co-founder and CTO at Offchain Labs. PhD candidate exploring economics, anonymity, and incentive comparability of cryptocurrencies.

Their combined expertise is an excellent showcase of how capable the team at Offchain Labs really are.

Is Arbitrum growing?

YES. In this bear market, Arbitrum has experienced a sharp increase in on-chain users. Additionally, liquidity has poured into this chain resulting in a higher total value locked (TVL) in comparison to its L2 rivals.

Arbitrum employs optimistic rollups. Optimistic rollups are settled on a sidechain. A sidechain is a blockchain that is connected to the main chain. This helps ease congestion by removing the computation required to confirm ETH transactions on the mainnet.

How do transactions actually work on Arbitrum?

The optimistic rollup proves that a computation performed is valid by taking it off Ethereum to sequencers, which shape these into batches, settle them on the side chain, and then feed the transaction back to Ethereum.

The vision and future of Arbitrum

Arbitrum doesn’t stop building! We’ve already seen:

- Increased throughput

- Advanced call data compression

- Ethereum L1 gas comparability

- Additional L1 interoperability

- Safer retryables

The future of Arbitrum is unfolding in front of you, a team committed to providing a sustainable on-chain future. The team is hard at work to:

- Improve user experience

- Further increase scalability

- Improving efficiency

- Maintaining optimal security

How to navigate the Arbitrum ecosystem

- How to get onto the Arbitrum ecosystem

- Exploring the Arbitrum ecosystem

- Exciting Arbitrum projects

Getting on to the Arbitrum ecosystem

First of all, you need to know how you can get your funds on the chain. This is simply through their official bridge link.

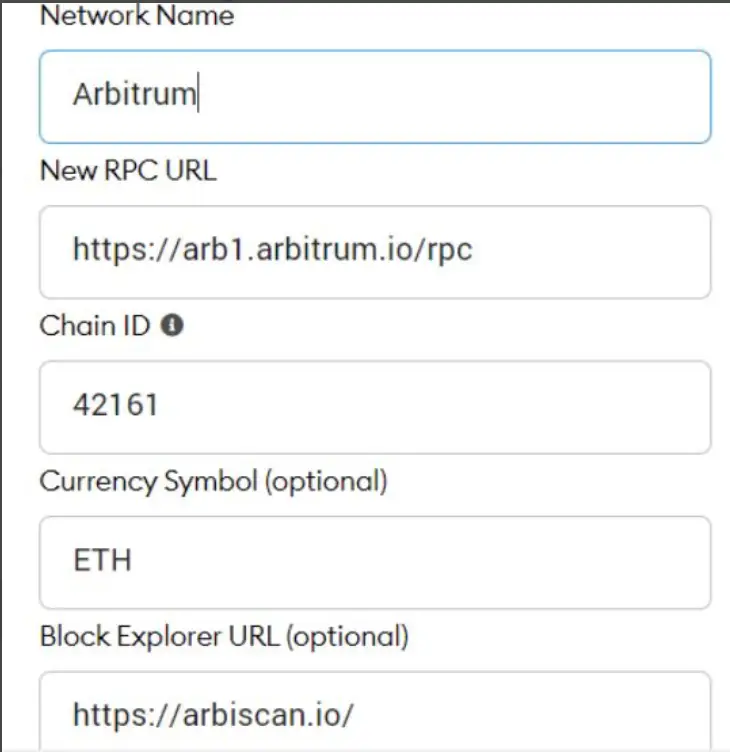

How do I add Arbitrum to my MetaMask?

You can do this by going to Uniswap to automate the process.

You can also do it manually:

Arbitrum Protocols to explore

Exciting Arbitrum projects

1. Factor DAO

2. Vela Exchange

3. Sperax (Stablecoin and DEX Liquidity Manager)

4. Umami Finance

Now that you’ve learnt what the Arbitrum ecosystem is and how to navigate it, I hope we can enjoy all the fruits that this growing L2 solution has to offer. Arbitrum is only going to get better.

The credit for this blog post goes to @crypthoem on Twitter. Kindly follow him to learn how to navigate the world of cryptocurrency.

Kathy Brooks is a digital marketing specialist at IPB Digital LLC. She is a technical writer that is fascinated with all things blockchain, cryptocurrency, digital assets and web3. Follow IPB Digital LLC on LinkedIn, Facebook and Twitter.